Getting the best foreign exchange rates can save businesses thousands. Here's what you need to know:

- Fair FX rates are based on the mid-market rate, the true value of one currency against another.

- Banks and many providers often add hidden markups, increasing costs for businesses.

- Factors like supply and demand, central bank policies, and political events influence rates.

- Avoid inflated rates by comparing offers to the mid-market rate and asking for transparent breakdowns.

- Tools like forward contracts and hedging can protect against currency fluctuations.

- Watch out for hidden fees like correspondent banking charges, weekend markups, and auto-conversion costs.

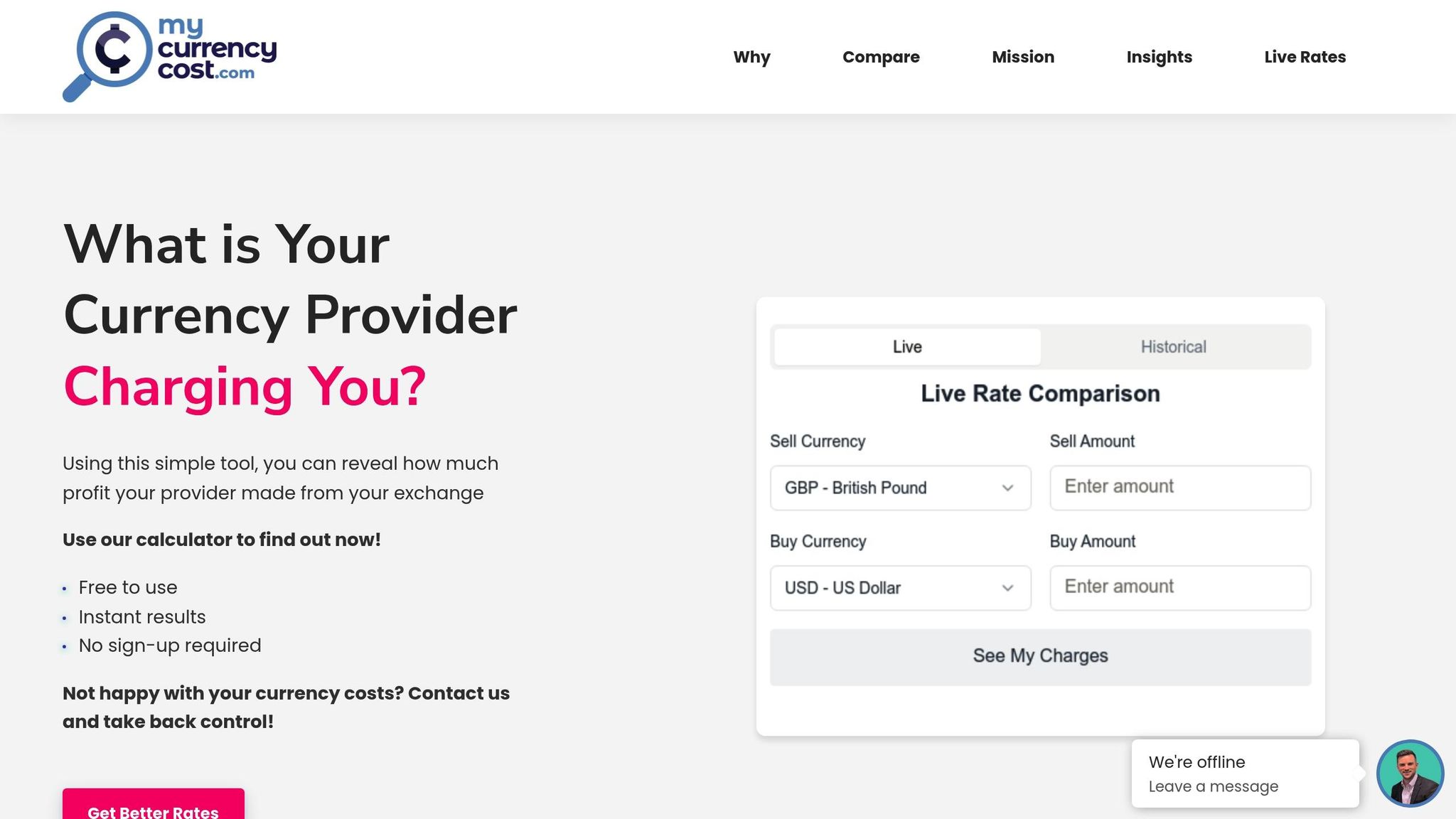

- Use platforms like mycurrencycost.com to compare rates and ensure you're not overpaying.

Key takeaway: Always benchmark the rate you're offered, account for all fees, and explore specialist providers to reduce costs and manage risks effectively.

How Fair FX Rates Are Determined

Grasping how foreign exchange (FX) rates are set can help UK businesses spot a fair deal. These rates are shaped by global economic forces that constantly influence currency values.

Main Factors That Influence FX Rates

The pricing of currencies hinges on a few key factors:

- Supply and demand: When more people want to buy pounds sterling than sell it, the pound gains strength against other currencies. On the flip side, if selling pressure outweighs demand, the pound weakens. This simple dynamic explains the constant ebb and flow of exchange rates.

- Central bank policies: Decisions by the Bank of England - like adjusting interest rates or implementing quantitative easing - can cause noticeable shifts in the pound's value. For instance, higher interest rates often attract investors seeking better returns, boosting the pound. Lower rates usually have the opposite effect.

- Economic indicators: Metrics like GDP growth, inflation, employment rates, and trade balances play a big role. Strong economic data tends to bolster the pound, while weaker figures can lead to depreciation. For example, the release of UK employment statistics or quarterly GDP reports often triggers movement in the currency market.

- Political events and stability: Political uncertainty can rattle exchange rates. The Brexit years (2016–2020) offer a clear example, with the pound experiencing significant volatility due to the uncertainty surrounding the UK's departure from the EU. Elections, policy changes, and geopolitical tensions also leave their mark on currency values.

- Market sentiment and speculation: Traders often act in anticipation of future events, which can amplify or temper the effects of fundamental factors. This speculative activity adds another layer of complexity to currency movements.

These elements work together to shape FX rates, forming the foundation for key terms discussed in the next section.

Key FX Rate Terms Explained

Here’s a breakdown of some important FX rate terms:

- Spot rate: This is the current exchange rate for immediate transactions, typically settled within two business days. It’s the rate you’ll see quoted on financial sites or trading platforms, serving as a reference point.

- Forward rates: These allow businesses to lock in an exchange rate for a future date, ranging from a week to several years ahead. Forward rates account for interest rate differences between countries. For example, if UK interest rates are higher than those in the eurozone, the forward rate for GBP/EUR will often be lower than the current spot rate.

- Real exchange rate: This adjusts nominal exchange rates to account for inflation differences between countries. It offers a clearer picture of a currency’s purchasing power. A currency may seem strong in nominal terms but could be weaker in real terms if domestic inflation is higher than that of its trading partners.

- Cross rates: These are exchange rates between two currencies that don’t involve the US dollar. For UK businesses trading with eurozone partners, the GBP/EUR cross rate is often more relevant than either currency’s relationship with the dollar.

Understanding these terms is key to recognising why fair FX rates are so important for businesses.

Why Fair FX Rates Matter for UK Businesses

Getting fair FX rates isn’t just about saving money - it’s about making smarter financial decisions. Even a small difference in rates can have a big impact. For example, a 1% difference on £500,000 worth of transactions adds up to £5,000 - a cost that directly affects profit margins. Over time, these small differences can snowball into significant losses.

Competitive edge in international markets is partly tied to exchange rates. UK exporters gain when they can convert foreign currency earnings at rates close to the mid-market rate. Similarly, importers can protect their margins by avoiding inflated rates on overseas payments.

Financial clarity is another crucial factor. Hidden markups by some providers can make it tricky to distinguish between actual currency fluctuations and fees. This lack of transparency can lead to poor budgeting, inaccurate forecasts, and flawed strategic decisions.

Cash flow management also benefits from fair rates. Predictable international payment costs mean businesses can allocate capital more efficiently and reduce the need for large contingency reserves. This improves working capital management and overall financial health.

Lastly, the regulatory landscape in the UK increasingly prioritises transparency in financial services. Fair exchange rates align with these expectations, helping businesses stay compliant with evolving rules on pricing disclosure and customer treatment.

How to Identify and Compare FX Rates

Understanding exchange rates goes beyond looking at the numbers banks and FX providers advertise. Many UK businesses lose significant sums each year simply because they don’t know how to properly assess FX costs.

Market Rates vs Quoted Rates

When banks or FX providers give you a quoted rate, it includes a markup added to the mid-market rate. This markup is their profit margin, and the key is figuring out how much you’re paying above the mid-market rate - and whether that amount is fair.

High street banks tend to charge higher markups compared to specialist FX brokers. For instance, on a £100,000 transaction, you might pay £500-£1,500 with a broker, but a bank could charge £2,000-£4,000 for the same deal.

Another important concept is the spread, which is the gap between the buying and selling rates a provider offers. A wider spread means higher costs for you. For example, if a provider quotes GBP/EUR at 1.1650 for buying euros and 1.1550 for selling them back, the spread is 100 pips (0.01), roughly equivalent to 0.86% in costs.

To truly understand your FX costs, follow a clear process for evaluating them step by step.

Steps to Evaluate FX Costs

Breaking down FX rates systematically can help you avoid overpaying.

- Start with the mid-market rate: Use the mid-market rate as your baseline. You can find this rate on financial data platforms or tools like mycurrencycost.com, which compare provider rates against the mid-market rate.

- Work out the total cost: Start with the amount you’ll receive. For example, if you’re exchanging £50,000 at 1.1500 EUR/GBP, you’d expect €57,500. If a provider offers you €56,500 instead, you’re effectively paying €1,000 in fees and markup - about 2% of the transaction value.

- Account for all fees: Beyond the exchange rate, providers may charge flat fees (£10-£25 per transaction), correspondent banking fees (£15-£40), or receiving bank charges. A provider offering a slightly better rate might still cost more when these fees are added.

- Check the timing of your quote: Exchange rates fluctuate during market hours (usually 8:00 AM to 5:00 PM GMT for major currency pairs). A rate quoted at 9:00 AM might not hold by 2:00 PM, especially in volatile markets. Always confirm how long a quote remains valid.

- Ask for written confirmation: Ensure the provider outlines all costs, including the exchange rate, fees, and the final amount the recipient will receive. If they can’t provide this transparency, it’s a warning sign.

Even with these steps, it’s important to stay vigilant about hidden costs that may not be immediately obvious.

Hidden Fees to Watch For

Beyond the visible markup on exchange rates, several hidden costs can drive up your FX expenses.

- Correspondent banking fees: If your UK bank doesn’t have a direct relationship with the receiving bank, intermediary banks may process the payment. Each intermediary can charge £15-£40, and these fees often only appear after the transaction is complete.

- Receiving bank charges: The destination bank may deduct fees from the incoming payment, leaving your recipient with less than expected. Some UK providers offer "OUR" payment instructions, where you cover all fees upfront to ensure your recipient gets the full amount.

- Weekend and holiday markups: Transactions outside regular market hours often incur an additional 0.5-1% markup, as providers claim higher market risk during these times.

- Minimum fee structures: For small transactions, minimum fees can be disproportionately expensive. A £10 fee on a £500 transfer equates to 2% in costs, even before considering the exchange rate markup.

- Auto-conversion fees: If your bank automatically converts foreign currency receipts, the markup is typically 3-5%, often worse than their standard international transfer rates. Businesses receiving regular foreign payments should negotiate better terms or consider specialist providers.

- Forward contract breakage fees: Cancelling or altering a forward contract can result in steep fees, often 1-2% of the contract value. Some providers offer more flexible terms, so it’s worth understanding these costs upfront.

Always request a detailed breakdown of all fees, including correspondent, receiving, weekend, minimum, auto-conversion, and forward contract breakage charges. Providers unwilling to provide this information often have something to hide. By being thorough, you can minimise your costs and avoid unnecessary surprises.

Tools and Resources for FX Rate Comparison

Having the right tools at your disposal can make a world of difference when it comes to analysing FX costs, making well-informed decisions, and negotiating better deals. These resources transform raw market data into actionable insights, helping you evaluate your options effectively.

Using mycurrencycost.com for Rate Comparisons

mycurrencycost.com provides a simple yet powerful way to check if you're getting a fair deal on your currency exchanges. The platform’s Cost Calculator allows you to input your transaction details and compare the rate you’ve been offered against historical wholesale market rates or your bank’s (or broker’s) approximate cost rate [6–8].

All you need to do is enter your transaction amount, currency pair, and the quoted rate. The tool will then calculate the markup over the wholesale rate, giving you a clear picture of the extra costs involved.

The platform prides itself on offering transparency in currency charges, ensuring impartial comparisons. By registering, you gain access to detailed insights for every trade, enabling you to track and understand your FX costs over time.

"Our belief is simple: these markups should be fair." – mycurrencycost.com

This level of clarity plays a key role in helping you secure fair rates on your transactions.

How to Read Rate Comparison Data

Interpreting rate comparison data is all about focusing on the numbers that directly affect your costs. While the headline exchange rate grabs attention, the real story lies in the details.

The markup percentage is a crucial metric. It shows how much more you’re paying compared to the wholesale rate. For straightforward spot conversions, a fair markup is typically around 0.5%, with even better rates available for larger transactions. If your markup is significantly higher, it might be worth negotiating.

Another key measure is the pip difference. FX brokers generally incur a small spread cost - usually between 2 and 7 pips - when purchasing currency at the interbank rate. They then add their markup before offering a rate to clients. Knowing this baseline can help you determine whether the markup you’re being charged is reasonable.

It’s also essential to account for timing when comparing rates. Currency markets fluctuate throughout trading hours (8:00–5:00 GMT), so ensure you’re comparing rates from similar timeframes. Additionally, don’t forget to factor in any additional fees beyond the exchange rate markup to get a complete picture of the total cost.

For businesses making frequent transactions, tracking your average markup over time can reveal whether your pricing is consistent - an indicator of a more transparent fee structure.

In addition to static comparisons, real-time and historical data can add another layer of insight to your decision-making process.

Real-Time and Historical Data for Better Decisions

Access to live currency data can help you time your transactions more effectively. When markets are moving in your favour, real-time rates can signal the best moments to act. On the other hand, historical data provides valuable context when evaluating quotes from providers.

For instance, analysing historical data can reveal recent volatility patterns for your currency pairs. Over a 12–24 month period, seasonal trends may also emerge, such as predictable movements around quarter-ends, holiday seasons, or major economic announcements. Recognising these patterns allows you to plan your transactions more strategically.

Historical data also comes in handy when assessing forward contract pricing. Comparing your provider’s quoted 6-month forward rate to historical averages for similar periods can help you spot discrepancies. If the quoted rate is noticeably worse than past trends, it could be worth questioning their pricing.

sbb-itb-1645b7c

Practical Methods to Reduce FX Costs

Cutting currency exchange costs doesn’t have to be complicated. By focusing on timing, risk management, and accurate financial reporting, businesses can better manage international transactions and improve their outcomes. Let’s explore some practical strategies to make this happen.

Timing FX Transactions

Timing your foreign exchange transactions wisely can make a big difference. Aim to trade during periods of peak liquidity - typically between 8:00 and 17:00 GMT - and pay attention to key economic events. For example, announcements from the Bank of England or GDP and employment data releases often trigger noticeable currency movements. If you’re aware of these events, you can plan to exchange currencies at more favourable rates.

Take this scenario: imagine you’re buying euros, and a positive eurozone economic announcement is expected. Waiting until after the announcement might secure a better GBP/EUR rate. This kind of economic calendar awareness is essential for timing your transactions effectively.

Another useful strategy is the averaging approach. Instead of exchanging a large sum all at once, break it into smaller amounts over several weeks. This can help you avoid the impact of short-term volatility, especially when dealing with unpredictable currencies from emerging markets.

For regular currency needs, consider setting target rates. When the market hits your desired rate, execute your transaction. This approach combines planning with flexibility, so you’re not constantly chasing market highs or lows. To further protect against adverse movements, pairing these tactics with forward contracts can offer even greater security.

Using Forward Contracts and Hedging

Forward contracts are a powerful tool for reducing uncertainty in currency exchange. They allow you to lock in a rate for a future transaction, which is particularly helpful if your business has predictable international cash flows or upcoming payments in foreign currencies. For instance, a UK manufacturer expecting a €500,000 payment in six months could use a forward contract to safeguard against an unfavourable EUR/GBP shift.

These contracts ensure you know the exact rate you’ll get, but they do come with trade-offs. While there’s no upfront cost, you’re locked into the agreed rate - even if the market moves in your favour later. To strike a balance, many businesses hedge only part of their currency exposure, leaving the rest unhedged to potentially benefit from favourable movements.

It’s also worth checking the pricing of forward contracts against historical data. If the quoted rate seems less competitive compared to past trends, it could indicate excessive margin-taking by your provider. Don’t hesitate to negotiate if needed.

Another option is natural hedging. If your business both receives and makes payments in the same foreign currency, you can offset these flows to reduce exposure without needing additional financial instruments. This approach simplifies risk management while keeping costs down.

Evaluating FX Costs in Financial Reporting

Accurate reporting of FX costs is just as important as timing and hedging. It ensures transparency, compliance, and better insights into how currency movements affect your business.

Under FRS 102, UK companies record foreign currency transactions at the exchange rate on the transaction date. Monetary items are then revalued at each balance sheet date, with exchange differences reflected in the profit and loss account. This helps maintain clarity around currency fluctuations.

For better decision-making, management reporting should separate operational performance from currency effects. For example, if a European sales division generates €100,000 in revenue, the GBP equivalent may vary each month due to exchange rate changes. Clearly distinguishing between these factors allows you to focus on operational results rather than being distracted by currency noise.

Using a budget rate methodology can also help manage FX volatility in financial planning. Set a budget exchange rate for the year - based on forward rates or conservative forecasts - and track variances between actual and budgeted rates. This approach isolates operational performance from exchange rate fluctuations.

Don’t forget to track all transaction costs, including exchange rate markups and additional fees. For example, if a provider charges a £25 fee plus a 1.2% markup on a £50,000 transaction, the total cost is £625. Breaking these costs down helps you identify providers offering genuinely competitive pricing.

The level of detail in your FX reporting should match your exposure. Businesses with significant currency movements may benefit from monthly analyses, while those with limited international dealings might find quarterly reviews sufficient. Including FX cost projections in your cash flow forecasts is also crucial. This ensures you account for conversion costs and avoid unexpected shortfalls.

Lastly, regularly review your provider’s performance. Monitor average markups and watch for increases that could indicate deteriorating pricing. If necessary, renegotiate terms or explore alternative providers.

Compliance and Best Practices for UK Businesses

Handling foreign exchange (FX) transactions goes beyond just securing good rates. It’s about staying aligned with UK regulations and setting up systems that safeguard your business. Proper compliance and accurate reporting ensure transparency in costs and adjustments, creating a fair approach to managing FX. Building on earlier points about evaluating FX costs, let’s dive into the compliance requirements and best practices UK businesses should follow.

UK Tax and Accounting Rules for FX Gains and Losses

HMRC has specific rules for how FX gains and losses are treated, depending on your business structure and the type of transactions. For trading activities, any FX gains or losses are usually included in your profit and loss accounts as they happen. For instance, changes in exchange rates between invoicing and payment are recognised immediately.

Capital transactions, however, follow a different path. If you’re acquiring overseas assets or making capital investments, the FX movements are generally factored into capital gains or losses instead of being treated as trading income. Proper classification here is crucial, especially when planning for international acquisitions or property investments.

The Corporation Tax Act 2009 also introduces rules for loan relationships, which impact FX transactions. For businesses holding foreign currency loans or deposits, exchange differences are included in tax calculations as they accrue. This means unrealised gains or losses on foreign currency balances need to be accounted for.

When it comes to VAT, foreign currency transactions must be converted into sterling using a consistent method, typically based on the supply date rate. This simplifies invoicing and ensures compliance.

Under accounting standards like FRS 102, transactions in foreign currencies are translated at the spot rate on the transaction date. Monetary items are then retranslated at each balance sheet date, with exchange differences recorded in profit and loss. This can lead to timing differences between accounting and tax treatments, requiring careful management.

Best Practices for Reporting FX Transactions

Accurate reporting starts with capturing all the key details of every FX transaction. This includes the transaction date, value date, currencies involved, amounts, exchange rates used, and any fees. Such detailed records are essential for audits or HMRC queries.

Recording FX transactions in real time can help prevent errors and make audits smoother. Additionally, structuring your chart of accounts to separate FX gains and losses - whether from trading, financing, or unrealised adjustments - makes tax compliance easier and provides clearer insights into how currency exposure impacts your business.

Monthly reconciliations between FX provider statements and your internal records are a must. They help identify discrepancies early on. Pay attention to value dates, as they determine when transactions settle and affect your cash flow. For example, a deal made on a Friday might not settle until the following Tuesday.

If your business deals with multiple currencies, maintaining a centralised FX register is vital. This should track all open positions, forward contracts, and major upcoming transactions. Regular updates to this register can guide board-level discussions on currency risk and hedging strategies.

For hedging activities, thorough documentation is essential. When using forward contracts or options, ensure you keep records linking these instruments to the underlying transactions they’re meant to protect. This not only ensures accurate accounting but also demonstrates to HMRC the commercial purpose behind these strategies.

Improving Currency Risk Management

Good FX reporting doesn’t just ensure compliance - it also lays the groundwork for managing currency risk effectively. Start by identifying all sources of foreign currency exposure. This includes direct risks, like export sales, and indirect ones, such as supply chain dependencies or broader economic factors.

Set clear risk limits with input from senior management. Your business’s tolerance for FX volatility should align with its financial health and strategic goals. Regularly review and document these limits as part of your risk management framework.

Scenario planning can be a game-changer. By modelling potential exchange rate changes - like a weakening sterling against the euro or a stronger dollar - you can assess the impact on cash flow, profits, and the balance sheet. Such exercises often uncover hidden risks and help shape better hedging strategies.

Consistent monitoring of FX positions is equally important. Businesses with high transaction volumes might need daily reviews, while others can manage with weekly or monthly checks. The key is to have a system in place that triggers timely action when currency movements demand it.

Board reports on FX should be clear and concise, covering current exposures, the financial impact of recent FX shifts, upcoming major transactions, and any updates to risk policies. Presenting FX impacts in terms like percentages of operating profit can help decision-makers grasp the significance.

Lastly, stress testing your FX risk strategy annually ensures it stays effective, even in volatile markets. Reflect on past periods of political or economic turbulence for insights. For larger businesses with significant international operations, forming dedicated FX committees to oversee currency risk might also be worth considering.

Conclusion: Key Points for Securing Fair FX Rates

Achieving fair foreign exchange rates is all about adopting a disciplined and transparent strategy. By focusing on benchmarking, clear comparisons, and careful timing, businesses can optimise their FX transactions and minimise unnecessary costs.

Start by benchmarking quotes against the mid-market rate and demanding full transparency in pricing. Define what "fair" means for your business by setting measurable targets, such as specific basis-point spreads over the mid-market rate. For major currencies, these spreads should reflect transaction size and market liquidity, giving you a concrete framework for negotiations.

When comparing quotes, insist on detailed breakdowns. This means collecting quotes that explicitly show the mid-market reference, spreads, fixed fees, and the total landed rate. Such documentation not only ensures like-for-like comparisons but also provides leverage during negotiations. Avoid offers that obscure embedded spreads with claims of "zero fees" - instead, request quotes that separate spreads from fixed fees and use independent benchmarks to evaluate margins. For cross-border transfers, using OUR charging can help prevent beneficiary shortfalls.

Timing is another critical factor. Market conditions can significantly impact spreads, especially during major data releases or illiquid trading hours. The London-New York overlap often offers tighter pricing, so aligning payments with these windows can lead to better rates. Additionally, pre-placing limit orders near target levels can help you avoid paying a premium during volatile periods.

Proper governance and documentation are essential for consistent improvement. Record every FX decision, noting key details like date, time, currency pair, and spread. This practice supports monthly KPI tracking, audit requirements, and trend analysis, helping you evaluate provider performance over time. For businesses with frequent FX needs, establishing internal policies - complete with approval thresholds, hedging guidelines, and performance metrics - creates accountability and drives better results.

Regulatory requirements also come into play. Under FRS 102, foreign currency transactions must be carefully accounted for, with monetary items retranslated at period-end and differences reflected in profit and loss. Aligning FX execution with documented hedging policies can help reduce P&L volatility.

Finally, leverage technology to strengthen your FX strategy. Platforms like mycurrencycost.com provide real-time comparisons, historical data, and market benchmarks, enabling smaller businesses to access insights previously reserved for larger institutions. These tools make it easier to validate pricing decisions and refine your approach.

Treating FX management as a core business discipline can lead to significant cost savings and reduced risk. By combining transparent pricing, rigorous comparison processes, strategic timing, and advanced tools, UK businesses can unlock meaningful financial benefits in the global FX markets, where even small execution improvements can have a big impact.

FAQs

How can I tell if the foreign exchange rate I’m being offered is fair and competitive?

To determine if the exchange rate you're being offered is reasonable, start by comparing it to the mid-market rate. This rate represents the midpoint between the buying and selling prices of a currency on the global market, making it a reliable indicator of a currency's actual value.

Next, take a closer look at the fees and margins imposed by the provider. Many banks or brokers build hidden charges into their exchange rates, so it's worth requesting a detailed breakdown of costs. A smaller bid-offer spread - the gap between the buying and selling rate - typically signals better value.

Lastly, check rates from multiple sources, such as official published rates or market averages, to see if the rate you're offered matches current market trends. Following these steps can help you make a well-informed decision and avoid paying more than necessary for currency exchanges.

How can my business minimise the impact of currency fluctuations?

To reduce the impact of currency fluctuations on your business, there are a couple of strategies worth considering: hedging and natural hedging.

Hedging tools, such as forward contracts and options, let you secure exchange rates in advance. This means you can shield your business from sudden, unfavourable shifts in currency values.

Natural hedging, on the other hand, focuses on balancing your revenues and expenses in the same currency. For instance, if your business earns income in euros, aim to cover some of your expenses in euros too. This method cuts down your exposure to exchange rate swings, helping to stabilise cash flow and bring more predictability to your international transactions.

What is the difference between spot rates and forward rates, and why does it matter in foreign exchange?

The spot rate represents the current market price for exchanging currencies on the spot, meaning the transaction happens immediately. In contrast, the forward rate is a pre-agreed rate set for a currency exchange that will occur on a future date. Knowing the difference between these two is crucial for businesses handling international transactions.

Spot rates work well for immediate payments or purchases but come with the risk of exchange rate swings. On the other hand, forward rates let businesses lock in a set rate for future transactions. This approach helps shield them from potential currency fluctuations, offering more stability and predictability. By using forward rates, companies can manage costs more effectively, minimise financial uncertainty, and plan cross-border operations with greater confidence.