When handling international payments, UK businesses with turnovers between £1m and £50m can save thousands by carefully comparing providers. Here's what to focus on:

- Exchange Rate Margins: These are often the largest cost. Even a 0.5% margin on a £500,000 transfer adds up to £2,500. Check for transparency.

- Transfer Fees: Providers may charge flat or percentage-based fees. Choose a structure that suits your payment size and frequency.

- Hidden Charges: Look out for intermediary bank fees, receiving bank costs, or extra charges for faster transfers.

- Provider Reliability: Speed, customer service, regulatory compliance, and currency support matter. Sometimes paying slightly more ensures smoother processes.

Options to Consider:

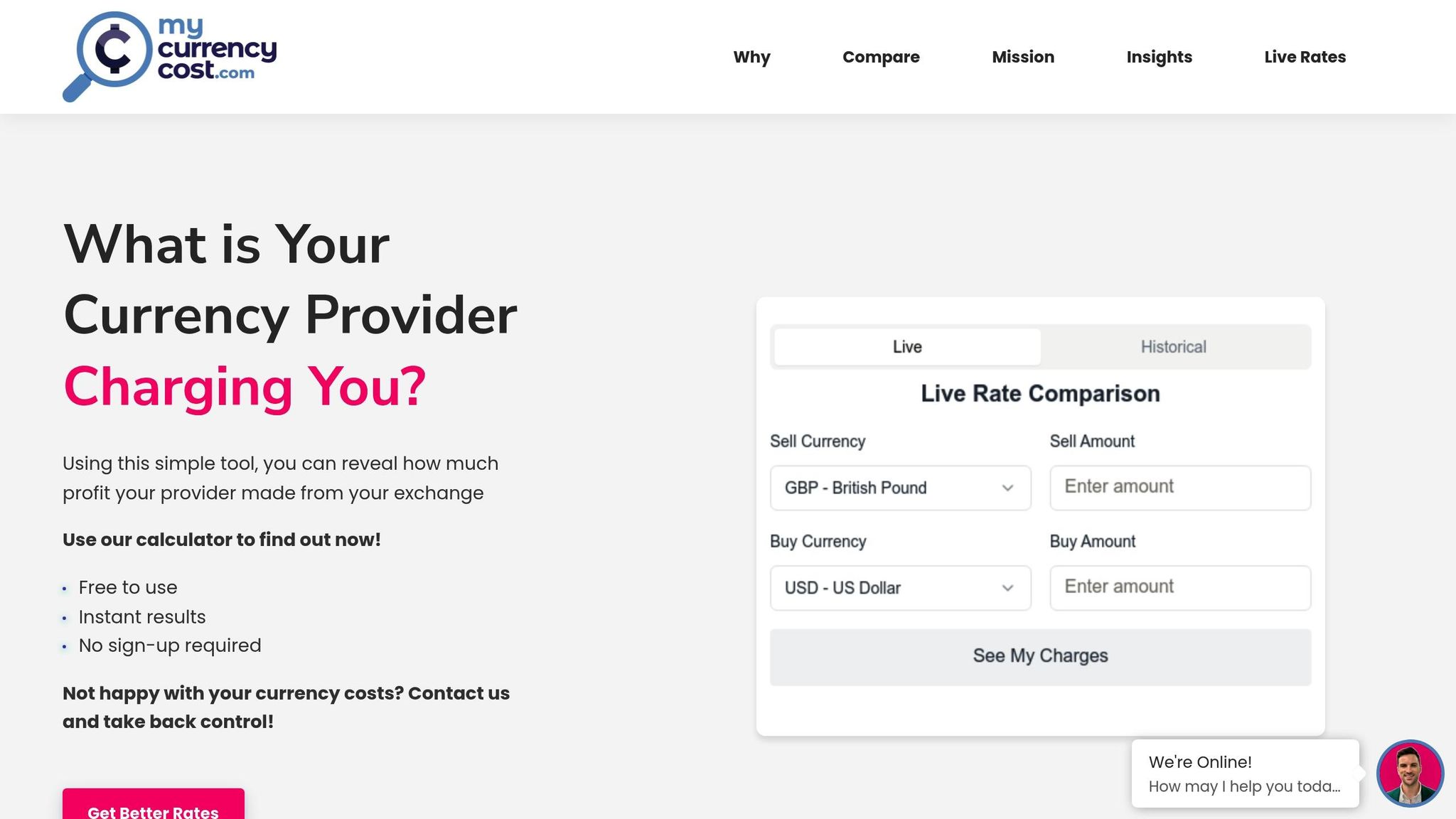

- mycurrencycost.com: A comparison tool that highlights real exchange rate margins and hidden costs but doesn’t process transactions directly.

- UK Banks: Convenient for existing customers but often more expensive, with higher fees and less competitive rates.

- Specialised FX Brokers: Lower fees, better rates, and faster processing but may require establishing new relationships.

Quick Comparison:

| Feature | mycurrencycost.com | UK Banks | Specialised FX Brokers |

|---|---|---|---|

| Exchange Rate Transparency | High | Low | Medium |

| Fee Structure | N/A (comparison only) | High | Low |

| Multi-Currency Support | Many currencies | Major currencies only | Wide range, including emerging markets |

| Processing Speed | N/A | Slower for uncommon pairs | Faster, often same-day |

| Regulatory Protection | N/A | FCA-regulated | FCA-regulated |

Takeaway: Regularly review providers to control costs. For frequent, high-value payments, FX brokers often provide better rates and speed. For occasional transfers, banks may offer convenience. Use tools like mycurrencycost.com to benchmark costs and make informed decisions.

The Truth About Wise Currency Exchange (vs Banks)

1. mycurrencycost.com

mycurrencycost.com is a platform designed to help UK businesses navigate the often confusing world of currency conversions. By providing a clear, data-driven comparison of providers, it enables users to assess the true cost of currency exchanges before making a decision. Here’s how it breaks down the key factors you should consider when comparing providers.

Exchange Rate Margins

Unlike payment providers, mycurrencycost.com focuses on analysing exchange rate margins using its Cost Calculator. This tool compares providers' margins against interbank data, giving you a transparent view of what you're really paying. For straightforward currency conversions, the platform suggests that a reasonable markup from the wholesale exchange rate is around 0.5%, with even better rates available for larger transactions. This benchmark can help you evaluate quotes from banks or brokers with confidence.

Transfer Fees

Since mycurrencycost.com isn’t a payment processor, it doesn’t charge transfer fees. Instead, it earns revenue by connecting you with providers that offer competitive rates, ensuring its recommendations remain unbiased.

Hidden Charges

Transparency is at the heart of mycurrencycost.com’s approach. Its Cost Calculator compares the rates you’re offered against historical interbank data, helping you spot any hidden fees or inflated charges. While actual rates can vary depending on trade size, currency pairs, and market conditions, the tool provides a reliable baseline to guide your decision-making process.

"We're committed to ensuring that every customer gets a fair deal for every exchange".

Provider Reliability

To ensure you’re getting the best deal, the platform uses historical interbank data and monitors rates over time. By registering for ongoing rate tracking, you can keep an eye on your provider’s pricing to ensure it stays competitive. This approach gives you the flexibility and information needed to make well-informed decisions about your currency exchanges.

2. UK Bank Providers

UK banks remain a go-to option for international payments, offering a familiar and straightforward pricing structure. However, their focus often leans towards convenience rather than competitive rates. Let’s break down how factors like exchange rate margins, transfer fees, and less obvious charges contribute to the overall cost.

Exchange Rate Margins

High street banks in the UK typically add a margin to the interbank exchange rate. This markup can significantly affect the cost, particularly for regular or high-value transactions. While some banks may allow for negotiation based on your relationship with them, a standard markup is usually applied across the board.

Transfer Fees

Fixed transfer fees are a common feature of international payments through UK banks. For smaller transactions, these fees can take up a considerable chunk of the total amount being sent. Some banks waive fees for premium account holders or for transfers above a certain amount, but these perks often come with higher account maintenance charges. Unless you’re frequently making international payments, the savings might not outweigh the added costs.

Hidden Charges

Banks may include additional charges that aren’t always obvious upfront. For example, intermediary fees can pop up when correspondent banks are involved in processing the transfer. On top of that, receiving banks might impose deductions, often called lifting fees. Being aware of these potential costs is crucial to understanding the true expense of your transfer.

Provider Reliability

UK banks operate under strict regulatory oversight and robust anti-fraud measures, with major institutions authorised by the Financial Conduct Authority. Their established networks typically ensure reliable processing times for international payments, making them a solid choice for businesses handling high volumes regularly. However, while customer support is accessible via multiple channels, specialised foreign exchange advice is often limited.

Multi-Currency Support

Top UK banks generally support a wide range of global currencies, but less common currency pairs might attract higher margins or face slower processing times. Many banks maintain accounts in key financial hubs, which can help speed up transfers for popular currency pairs like the British pound to the euro or US dollar. Businesses can also access forward contracts and other hedging tools, though these options may come with minimum transaction requirements.

sbb-itb-1645b7c

3. Specialised FX Brokers

When it comes to reducing the cost of international payments, specialised FX brokers present a compelling alternative. These providers focus exclusively on currency exchange and cross-border transfers, offering tailored solutions. Here's how they measure up in key areas:

Exchange Rate Margins

Specialised FX brokers generally provide tighter margins compared to traditional banks. The margin you get often depends on factors like the size of the transaction, how frequently you trade, and the currency pair involved. For example, common pairs like GBP/EUR or GBP/USD tend to come with better rates, while less frequently traded currencies might have wider spreads. Many brokers also offer tiered pricing, where higher transaction volumes unlock better rates. Features like rate alerts and forward contracts are often available, allowing businesses to lock in favourable rates for future transactions.

Transfer Fees

Most FX brokers operate on a low-fee or even fee-free model for standard transfers, relying primarily on exchange rate margins for their revenue. This approach can be particularly appealing for businesses making regular international payments. However, urgent or same-day transfers may incur additional charges. In some cases, brokers waive transfer fees entirely for larger transactions, making them more cost-effective for high-value payments.

Hidden Charges

Transparency is a point of pride for many FX brokers, but there are still instances where unexpected costs might arise. For example, intermediary bank fees can sometimes apply, especially for less common currency routes or destinations outside a broker's direct network. Payment methods can also affect costs, with some options carrying additional processing fees. This level of clarity helps businesses make informed choices and assess a broker's trustworthiness.

Provider Reliability

In the UK, FX brokers are regulated by the Financial Conduct Authority (FCA), ensuring adherence to strict standards, including the safeguarding of client funds. Customer money is usually held in segregated accounts for added security. Compared to traditional banks, specialised brokers often offer faster transaction times, with same-day transfers available for popular currency pairs if submitted before the broker's cut-off time. Their expertise in foreign exchange typically results in smoother processes and fewer delays.

Multi-Currency Support

Specialised brokers usually support a wide range of currencies, often exceeding the options offered by high street banks. This includes emerging market currencies, which banks may either not handle or price less competitively. Additionally, many brokers provide multi-currency accounts, enabling businesses to hold balances in different currencies and make conversions when market conditions are favourable.

Advantages and Disadvantages

When deciding between different payment providers, it's essential to weigh the pros and cons of each option. Each provider brings its own set of benefits and limitations, and understanding these can help you choose the one that best aligns with your business needs and transaction habits. Here’s a closer look at how the options stack up.

mycurrencycost.com shines when it comes to transparency. Its tools allow businesses to spot potential markups and compare rates with actual market values. However, since it’s a comparison service, transactions still need to be processed through a bank or broker.

UK banks are a familiar choice for many businesses, offering the convenience of existing relationships and integrated banking services. As FCA-regulated institutions, they provide reliable processing and security. That said, their fees can be steep, especially for less common currency pairs, and exchange rate margins are often less competitive.

Specialised FX brokers offer a strong alternative, frequently providing better exchange rates and lower fees, as their pricing is primarily margin-based. They also excel with faster processing times and access to a wider array of currencies, including emerging markets. On the downside, establishing a new relationship with a broker can be a hurdle for some businesses, though FCA regulation ensures a level of trust and security similar to banks.

To make these differences clearer, here’s a quick breakdown:

| Feature | mycurrencycost.com | UK Banks | Specialised FX Brokers |

|---|---|---|---|

| Exchange Rate Transparency | Excellent – shows real market rates vs provider rates | Limited – margins often unclear | Good – margins are clearly outlined |

| Fee Structure | N/A – comparison service | High – multiple fees may apply | Low to negligible – margin-based |

| Multi-Currency Support | Comprehensive – compares many currencies | Limited to major currencies | Extensive – includes emerging markets |

| Processing Speed | N/A – comparison only | Slower for less common pairs | Fast – often same day for major pairs |

| Regulatory Protection | Not applicable (comparison service) | Full UK banking regulation | FCA regulated with client money protection |

| Relationship Management | Self-service platform | Dedicated relationship managers | Personalised service with FX expertise |

Choosing the right provider depends heavily on your business’s payment patterns. If you make frequent, high-value international payments, specialised brokers might be the way to go, thanks to their competitive rates and speed. On the other hand, businesses that value convenience and already have established banking relationships might accept the higher costs banks typically charge.

For businesses with irregular payment needs, tools like those offered by mycurrencycost.com can be particularly helpful. They provide the transparency needed to decide whether a bank’s convenience is worth the premium or if turning to a specialist provider is the smarter financial choice.

Summary

Managing international payments effectively requires a focus on clarity, affordability, and ease of use.

For businesses making regular international transactions, specialised foreign exchange (FX) brokers often provide more competitive rates. On the other hand, traditional UK banks may be more suitable for occasional transfers, offering convenience and integrated services. However, hidden fees and unclear pricing can make it difficult to assess the true cost of these transactions. Platforms like mycurrencycost.com can be invaluable, offering a clear comparison between real market rates and provider rates. This enables businesses to make well-informed decisions based on actual costs. For owner-managed businesses with annual turnovers between £1 million and £50 million, using such comparison tools is a smart way to benchmark expenses before committing to a provider.

By embracing transparency, businesses can negotiate better terms, either with their current bank or by exploring specialised providers when the savings are worth the switch.

Successful businesses treat international payment costs as manageable expenses rather than fixed overheads. Regularly reviewing providers ensures they stay aligned with your evolving needs, helping you keep costs under control.

FAQs

How can I ensure I’m getting a fair and transparent exchange rate for international payments?

To maintain clarity and honesty in exchange rates, opt for a provider that openly shares their exchange rate margins and any related fees. Providers who publish their rates transparently and steer clear of hidden charges make it easier for you to compare options and make well-informed decisions.

You might also want to explore providers that offer guaranteed or fixed exchange rates for a set timeframe. This feature can shield you from sudden rate changes, giving you more control over expenses and ensuring smoother business transactions.

What hidden charges should I look out for when making international payments?

When sending money internationally, hidden charges can quickly inflate your costs if you're not paying attention. A major element to watch out for is the exchange rate markup. This is an extra margin added to the mid-market rate, making your transfer more expensive - even when it's advertised as 'fee-free'. On top of that, you might face transfer fees, intermediary bank charges, and receiving bank fees, which are often not clearly outlined in advance.

These expenses can pile up fast, so it's crucial to carefully check the terms and conditions of your payment provider. Opt for services that are upfront about their pricing. You can also use comparison tools to evaluate rates and fees, helping you find the best deal for your international payments.

Why do specialised FX brokers often provide better rates and quicker transfers than UK banks?

Specialised FX brokers stand out by providing better exchange rates and quicker transfer times compared to UK banks. Why? Because they’re laser-focused on currency exchange. With lower overheads and advanced tech like straight-through processing (STP), they streamline transactions, cutting out delays caused by manual handling.

Unlike traditional banks, these brokers tap into a broader network of liquidity providers. This allows them to deliver more competitive rates alongside tailored solutions. For businesses, this means cost savings and smoother international payment processes.