Foreign exchange (FX) rates offered by banks often include hidden markups, which can significantly increase costs for UK businesses handling international transactions. These markups, which can range from 2% to 4%, are added to the wholesale market rate - aka “interbank” rate, the benchmark rate used between banks. This guide explains how to compare real FX rates with bank rates and highlights tools to reduce FX costs.

Key Points:

- Interbank Rate: The base rate used between banks, free of markups.

- Bank Markups: Banks add 2%–4% to the wholesale rate, increasing transaction costs.

- Hidden Fees: Additional charges include transfer fees (£0–£35), intermediary deductions (£11–£38), and receiving bank fees (£2–£7).

- Impact on Businesses: A 3% markup on £100,000 monthly payments costs £36,000 annually.

- Tools for Comparison: Platforms like mycurrencycost.com identify markups by comparing market rates with bank rates.

Steps to Check FX Rates:

- Find the Real Rate: Use sources like the Bank of England, OANDA, or XE to access real market rates.

- Get Your Bank’s Rate: Request the exact rate from your bank, including all fees. You can probably download your transaction history as an Excel file.

- Compare and Calculate: Subtract the market rate from your bank’s rate, divide by the market rate, and multiply by 100 to find the percentage markup.

Reducing FX Costs:

- Timing Transactions: Monitor market trends and use forward contracts or limit orders.

- Negotiate Rates: Build a strong relationship with your bank and leverage transaction volumes.

- Use Tools: Platforms like mycurrencycost.com provide transparency and help in rate comparisons.

For example, if the market rate for GBP/EUR is 1.1650 and your bank offers 1.1450, the 0.0200 difference equates to a 1.72% markup. On a £50,000 transaction, this adds £860 (€1,000) in extra costs.

Understanding and actively managing FX costs can save your business thousands annually.

Real FX Rates vs Bank Rates: The Basics

Grasping the difference between real FX rates and bank rates is crucial because the gap between them directly affects your expenses. Let’s break down what these rates are and how banks adjust them.

What Are Interbank FX Rates?

Interbank FX rates act as the benchmark and, in a sense, the purest form of currency exchange rates. The “mid-market” rate represents the midpoint between a currency's buy and sell prices on the global market. These rates are what banks use when trading large amounts of currency with each other. However, they’re not static - they shift throughout the trading day as market conditions evolve. While interbank rates set the stage for fair conversions, they don’t reflect the rates most individuals or businesses end up paying, as banks typically add their own markups.

How Banks Add Markups to FX Rates

Banks apply a markup to the market rate when processing international payments, turning it into a source of profit. This markup is essentially a percentage added to the exchange rate when they trade a currency pair. Markups often range between 2% and 4%, though they can vary from under 1% to as high as 5%. For example, if the market rate for EUR/USD is 1.1000, a bank might adjust it to 1.0800 with their markup. On a $1,000 transfer, this seemingly small difference means you’d pay €925 instead of €909 - a €16 increase. Over time and with larger transactions, these differences can become substantial. Importantly, banks embed these markups directly into the exchange rate, making them less transparent for customers.

Why This Matters for UK Businesses

For UK businesses dealing in international trade, even minor markups can eat into profits or inflate costs. Consider this: if a business processes £100,000 in international payments each month, a 3% markup would cost about £3,000. Over a year, that’s approximately £36,000 lost. Beyond the financial hit, these hidden costs make it harder to plan budgets and set competitive prices. Without a clear understanding of these markups, businesses risk overpaying on FX transactions and losing their edge in competitive markets. To stay ahead, it’s essential to identify these costs and negotiate better terms with financial providers.

Hidden Fees and Markups in FX Transactions

When it comes to foreign exchange (FX) services, banks often bury fees within their processes, making it tough for businesses to figure out the actual costs they’re incurring. Let’s break down the most common hidden charges and how they can affect your business finances.

Types of Hidden Costs

One of the most common ways banks profit from FX transactions is by embedding a margin into the exchange rate. For major UK high street banks, this markup typically falls between 2.5% and 3.7%.

"Banks still hide their mark-ups and refuse to be transparent, because they believe hiding fees gets customers to overpay." – Kristo Käärmann, chief executive and co-founder, Wise

Beyond these markups, additional charges can include:

- Wire transfer fees: £0–£35

- Intermediary bank deductions: £11–£38

- Receiving bank fees: £2–£7

- Small-print costs: Such as account maintenance or amendment fees

Banks may also engage in practices like selective exchange rate quotes, where they offer different rates depending on the perceived value of your business. Another tactic is selective exchange rate adjustments, where banks pass on unfavourable market movements but keep the benefits of favourable ones for themselves. Then there’s dumping - a strategy where banks attract new clients with competitive rates for their first transaction, only to quietly increase the spreads for subsequent payments.

Impact on Business Costs

For UK businesses, these hidden fees can add up alarmingly fast. In 2023, British SMEs collectively lost £2.8 billion to these charges. On a broader scale, small businesses in the UK spend roughly £4 billion annually just on FX fees when purchasing goods and services internationally.

To put this into perspective, imagine your UK-based business needs to send a £50,000 payment to a supplier in the US. Between transfer fees, FX rate margins, SWIFT fees, and receiving bank charges, the total cost could range from £500 to £2000.

"What banks advertise is that transfers are free, low cost, but they don't disclose the 3% or 4% markup that they are charging... Customers deserve to know how much they are being charged." – Magali Van Bulck, Wise's Emea Policy Head

These costs don’t just hurt financially - they also create operational headaches. Many businesses struggle to anticipate their international payment expenses due to the lack of transparency. In fact, studies show that total spreads on foreign currency transactions can reach up to 3.71%, with fixed fees disproportionately impacting smaller businesses.

The administrative burden of untangling these opaque fee structures is another challenge. It takes time and energy away from running and growing a business.

"This lack of transparency causes unnecessary admin and worry for both people and business owners. Rather than focusing on growing their business and doing their job, too many entrepreneurs are spending valuable time trying to stay on top of disparate and vague payment processes." – Rasika Raina, Senior Vice President of Cross-border Payments at Mastercard

Globally, the scale of hidden FX fees is staggering. In a single year, consumers lost £180 billion to these charges. In the US alone, SMEs and consumers paid $17.9 billion in FX transaction fees in 2023, with approximately $5.8 billion of that attributed to hidden exchange rate markups.

Tools to Compare Real FX Rates with Bank Rates

Understanding the impact of hidden fees is just the start. To truly get a handle on foreign exchange (FX) costs, you need tools that compare real market rates with the rates your bank offers.

Getting Real FX Rates from Trusted Sources

The interbank rate, is your baseline. This is the rate banks use when trading large amounts of currency with each other, before adding their markups. It’s not typically available for smaller transactions, as banks and money transfer services apply additional fees to turn a profit.

To check real FX rates, start with these trusted sources:

- Bank of England: A key reference for Sterling rates, the Bank of England publishes daily spot rates for major currencies like EUR and USD against GBP. While these rates are reliable, they are not necessarily more authoritative than those from commercial banks operating in the London FX market .

- OANDA: Known for its comprehensive data, OANDA offers over 31 years of historical information on 38,000+ forex pairs and rates for more than 200 currencies, commodities, and metals. Their OANDA Rates™ are sourced from leading market contributors, with records going back to January 1990.

- XE: A widely used tool for accurate exchange rate information, XE pulls data from reputable banks and providers. Their API supports hundreds of currencies, making it a go-to source for up-to-date rates.

Timing is critical when checking rates. Currency liquidity is highest during peak trading hours - typically from 8am GMT to 5pm EST, when both UK and US markets are open. This window often reflects the most accurate market conditions.

By comparing rates across multiple sources, you can get a clearer picture of the true market rate.

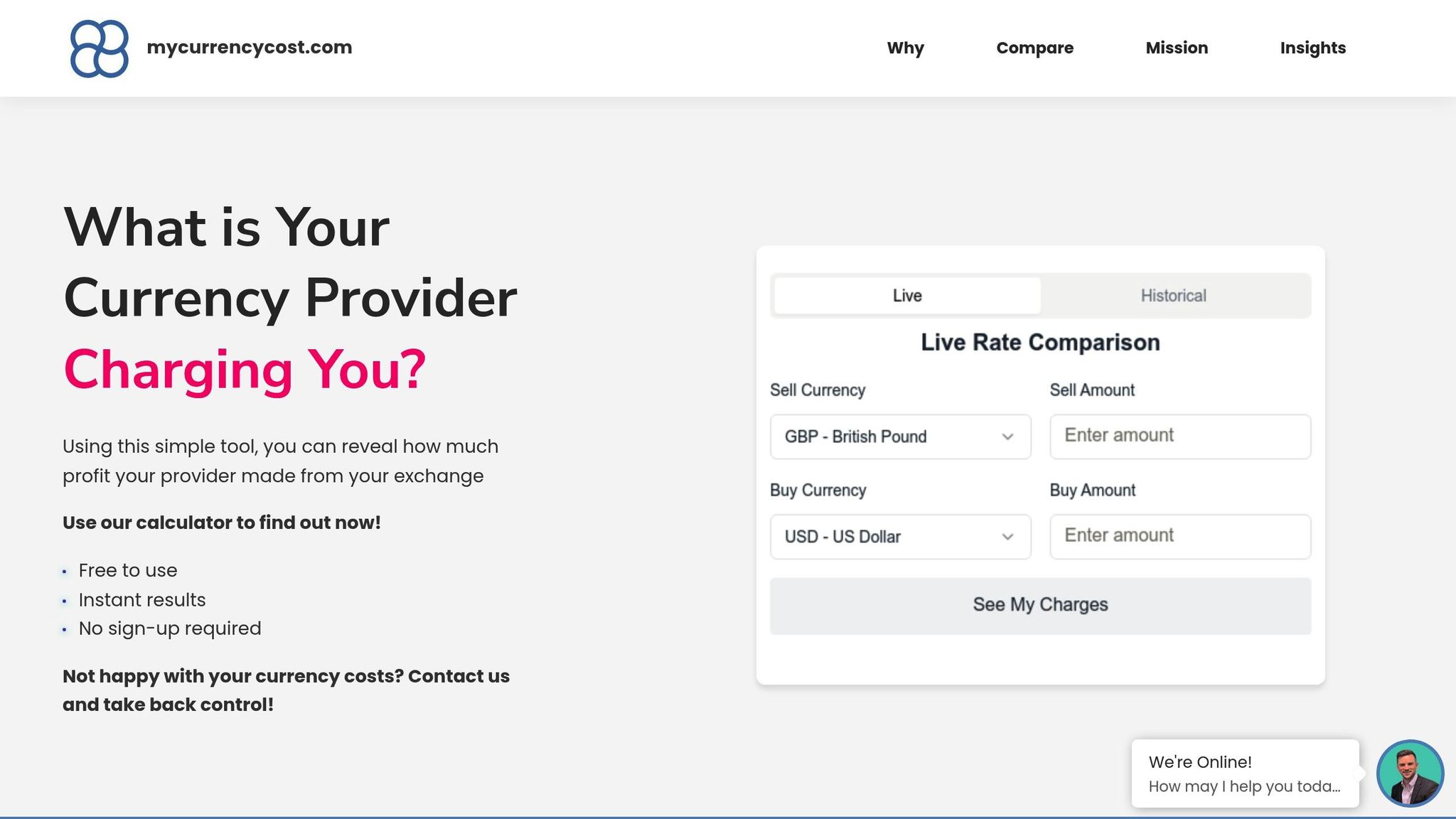

How mycurrencycost.com Simplifies FX Rate Comparison

For businesses looking to plan ahead, the historical rate analysis feature is particularly useful. It allows you to review rate trends over weeks, months, or even years, helping you decide the best time for larger transactions. This is especially valuable for businesses managing recurring payments or dealing with volatile currency pairs.

If your business uses forward contracts, mycurrencycost.com also enables forward rate comparisons. This feature helps you determine if the premiums included in your bank’s forward rates are reasonable or inflated. Since small differences in rates can have a big impact over time, this insight is crucial when locking in rates for future payments.

What makes mycurrencycost.com stand out is its focus on markup identification. Instead of just listing exchange rates, it calculates the percentage difference between the interbank rate and the rates offered by banks. This gives you a clear understanding of how much extra you’re paying.

The tool covers a wide range of currency pairs, from major ones like GBP, EUR and USD to emerging market currencies that UK businesses might encounter. Whether you’re handling regular supplier payments or occasional international purchases, the platform adjusts to your specific needs.

For more complex scenarios, such as multi-currency transactions or timing strategies for significant FX exposures, mycurrencycost.com provides expert assistance through its contact system. This added support can be invaluable when managing large or intricate transactions.

sbb-itb-1645b7c

Step-by-Step Guide to Checking FX Rates

Understanding how to compare the real FX rate with the one offered by your bank can save you money when exchanging currencies. This straightforward three-step method will help you uncover any hidden markup in your bank's rates.

Step 1: Find the Real Market FX Rate

Start by identifying the interbank rate, often referred to as the "real" exchange rate. This is the rate banks use when trading currencies with each other before adding any profit margins.

Visit mycurrencycost.com to check the current market rate for your chosen currency pair. Make sure to note the timestamp of the rate for accuracy, as exchange rates can fluctuate throughout the day.

Step 2: Get Your Bank’s Exchange Rate

Next, contact your bank to get their quoted exchange rate for the same currency pair and transaction amount. Be specific about the amount you plan to exchange, as rates for £10,000 might differ from those for £50,000.

Ask for the "all-in" rate, which includes any fees or charges applied to the transaction. Avoid vague estimates like "around 1.15" - request the exact rate and confirm how long the quote remains valid. To ensure a fair comparison, obtain this rate immediately after checking the mid-market rate.

Step 3: Compare the Rates and Calculate the Markup

Now, compare your bank’s rate to the mid-market rate to determine the markup. Subtract the mid-market rate from your bank’s rate, divide the difference by the mid-market rate, and multiply by 100 to get the percentage markup.

For instance, if the mid-market rate for GBP/EUR is 1.1650 and your bank offers 1.1450, the difference of 0.0200 translates to a 1.72% markup.

To understand the extra cost in monetary terms, multiply the rate difference by the amount you’re converting. For example, converting £25,000 at a 0.0200 difference would mean you buy €500 less compared to the real market rate:

- £25,000 × 0.0200 = €500 less

Here’s how the numbers look for different transaction amounts (in GBPEUR):

| Transaction Amount | Mid-Market Rate | Bank Rate | Rate Difference | Extra Cost (euro) |

|---|---|---|---|---|

| £25,000 | 1.1650 | 1.1450 | 0.0200 | €500.00 |

| £50,000 | 1.1650 | 1.1450 | 0.0200 | €1,000.00 |

| £100,000 | 1.1650 | 1.1450 | 0.0200 | €2,000.00 |

These calculations reveal how much extra you’re paying due to the bank’s markup. To make this process easier, mycurrencycost.com offers an automated tool that instantly calculates the percentage difference and additional cost when you input your transaction details. It’s a quick way to see how your bank’s rate stacks up against the mid-market rate.

How to Reduce FX Costs for UK Businesses

Once you've identified the markup your bank applies, it's time to take action and implement strategies to lower your foreign exchange (FX) costs. With careful planning and management, UK businesses can save thousands of pounds annually on currency transactions.

Timing FX Transactions

The FX market is in constant motion, and these fluctuations can significantly affect your costs. Timing your transactions wisely can make a real difference. Instead of converting currency whenever it's needed, keeping an eye on market trends can help you spot the best times to buy or sell.

For example, major economic events, like Bank of England interest rate announcements, often cause significant changes in the value of GBP. These announcements typically happen around eight times a year and can create opportunities for businesses to act on favourable rates.

Tools like forward contracts are a great way to manage FX risk. They allow you to lock in today's exchange rate for a transaction that will happen in the future. Say you know you'll need a specific amount of foreign currency in three months - securing the rate now protects you from any unfavourable changes in the meantime.

Another option is using limit orders, which automate transactions when your target exchange rate is reached. This way, you don’t have to monitor the market constantly. The system will execute the trade as soon as the desired rate becomes available, ensuring you don’t miss out on opportunities.

Multi-currency accounts are also worth considering. They let you hold funds in different currencies, helping you avoid unnecessary conversions at unfavourable rates.

Once you've mastered timing, the next step is to negotiate better terms with your bank.

Negotiating Better Rates with Banks

A strong relationship with your bank can lead to more competitive FX rates. Banks often have flexibility in their pricing, particularly for businesses with regular transactions or high volumes.

Start by discussing your FX needs with your bank. Many banks offer dedicated FX services, and you might qualify for preferential rates if your business maintains consistent transaction volumes or holds a significant account balance.

Shortening your payment terms is another way to reduce FX risks. For example, if you usually offer 60-day payment terms, consider reducing them to minimise your exposure to potential currency fluctuations.

You could also negotiate the invoicing currency with your customers. If you’re a UK exporter, invoicing in GBP shifts the currency risk to the buyer, reducing your own exposure. This approach works best when you have strong leverage in negotiations and clear data to back your case.

When entering discussions with your bank, bring detailed information about your transaction volumes, frequency, and any competitive quotes you’ve received. Demonstrating the potential for a long-term partnership can help you secure better rates.

After timing and negotiation, digital tools can further strengthen your cost-saving efforts.

Using mycurrencycost.com to Save on FX Costs

To complement these strategies, tools like mycurrencycost.com can enhance transparency and help you make informed decisions. This platform compares your bank's exchange rate to the true market rate, clearly showing the markup applied. Armed with this data, you’ll have stronger leverage when negotiating rates with your bank.

By registering your trade details, mycurrencycost.com allows you to check whether your currency conversions offer fair value. While it doesn’t provide FX services directly, it serves as an independent benchmark, giving you a clear view of your FX costs.

Regularly monitoring your transactions through mycurrencycost.com ensures you stay on top of trends, helping you identify opportunities to renegotiate terms or adjust your strategy. This added insight can make a noticeable difference in managing your FX expenses effectively.

Conclusion: Making Smart FX Decisions

For UK businesses navigating the global marketplace, understanding the difference between real and bank FX rates is essential to safeguard profitability.

Currency fluctuations can have a major impact on costs. For instance, in July 2024, UK exports of goods dropped by £3.4 billion (10.8%), while imports fell by £1.5 billion (3.0%). These numbers clearly show how exchange rate movements can directly influence business operations and financial outcomes.

Transparency and regular monitoring are key to making informed FX choices. Transparency helps uncover hidden markups that might be inflating costs unnecessarily. Tools like mycurrencycost.com allow businesses to compare offered FX rates against historical wholesale market prices, providing clear insights into currency charges.

Strategies such as using forward contracts or multi-currency accounts can help secure favourable rates, but their success depends on fully understanding your actual FX costs. The techniques discussed - such as timing transactions wisely and negotiating better rates with your bank - are most effective when paired with consistent monitoring and rate comparisons.

Staying informed about market trends can lead to significant savings. Demonstrating an understanding of market rates and benchmarking your bank's offerings gives you a stronger position in negotiations. The impartial nature of platforms like mycurrencycost.com, which do not sell FX services, ensures unbiased evaluations of your transactions.

FAQs

How can I tell if my bank is adding extra charges to foreign exchange rates?

To see if your bank is adding extra charges to foreign exchange (FX) rates, compare their offered rate with the mid-market rate - this is the real exchange rate used in global currency trading. Platforms like XE or OANDA are great places to check the mid-market rate.

The difference between your bank's rate and the mid-market rate, shown as a percentage, reveals the markup. For instance, if your bank offers £1 = $1.20 and the mid-market rate is £1 = $1.23, the markup is roughly 2.44%. While some banks may openly disclose this markup, you can always calculate it yourself by comparing the rates and determining the percentage difference.

Understanding these charges can help you make smarter choices and save money when exchanging currencies.

How can UK businesses reduce the financial risks of fluctuating exchange rates?

UK businesses can shield themselves from the ups and downs of exchange rates by implementing hedging strategies. For instance, forward contracts let companies lock in an exchange rate for future transactions, while currency swaps help manage exposure. These tools are handy for reducing uncertainty and keeping costs predictable when dealing with international payments.

Another smart move is setting up a multi-currency account, which allows businesses to hold and manage funds in various currencies. This reduces the need for constant currency conversions and cuts down on transaction risks. On top of that, having a well-defined foreign exchange policy - complete with clear objectives, risk limits, and regular monitoring - can bring structure and ensure businesses stay on top of their FX exposure.

By using these approaches, companies can save money, dodge unexpected costs, and maintain financial stability while navigating international markets.

Why should businesses regularly compare mid-market exchange rates with bank rates, and how can it help save money?

Businesses should keep an eye on mid-market exchange rates and compare them with the rates offered by banks. Why? Because mid-market rates reflect the genuine market value of a currency pair - free from any sneaky markups or hidden charges. On the other hand, banks and currency providers often tack on extra margins, which means businesses might end up paying more than they should for currency exchanges.

By understanding mid-market rates, businesses can identify these hidden costs and make smarter choices when handling foreign currency transactions. This can lead to cutting unnecessary expenses, maintaining healthier cash flow, and safeguarding profit margins - particularly during times of currency volatility. Keeping tabs on these rates ensures businesses get the most value out of their international payments.