Spot rates and forward contract rates are two key options for managing currency exchanges. Spot rates reflect the current market price for immediate transactions, while forward contract rates lock in a future exchange rate to protect against currency fluctuations. Both have unique uses:

- Spot Rates: Best for immediate needs or taking advantage of favourable rates. Transactions settle within two business days.

- Forward Contract Rates: Ideal for planned, future transactions. They provide predictability by fixing rates in advance, often for 3, 6, or 12 months.

Quick Comparison

| Factor | Spot Rates | Forward Contract Rates |

|---|---|---|

| Settlement Timing | Immediate (T+2) | Future date (e.g., 3, 6, or 12 months) |

| Rate Basis | Current market rate | Spot rate adjusted for interest rate gap |

| Flexibility | High | Low (fixed date and amount) |

| Risk Exposure | Full exposure to market fluctuations | Protection from adverse movements |

| Best For | Urgent payments, quick decisions | Budgeting, large planned transactions |

The choice between spot and forward rates depends on your financial goals, risk tolerance, and transaction timing. Spot rates offer flexibility, while forward contracts provide stability for future planning.

Spot and Forward Exchange Rates Explained in 5 Minutes

Spot Rates: How They Work and When to Use Them

Spot rates provide a straightforward way for UK businesses to handle currency exchanges, offering immediate access to the current market rate without the need for complex contracts.

How Spot Rates Work

A spot rate reflects the current exchange rate for converting one currency into another, with settlement typically completed in two business days (T+2). For example, if you agree to exchange pounds for euros on a Monday, the transaction settles by Wednesday. The agreed rate remains fixed during this period, shielding you from any market fluctuations until the settlement is finalised.

Spot rates are highly dynamic, shifting throughout the trading day in response to market forces like economic reports, political events, and trading activity. This real-time nature makes them a practical choice for businesses operating in fast-changing markets.

Best Uses for Spot Rates

Spot rates are particularly useful for situations where urgency or flexibility is key. For example, if a company importing goods from the EU receives an unexpected invoice, using the spot rate allows for quick payment, helping to maintain strong supplier relationships.

They’re also ideal for taking advantage of favourable market conditions. If the exchange rate moves in your favour, you can act immediately without waiting for a future contract date. This is especially beneficial for businesses that can adjust their payment schedules to align with advantageous exchange rates.

For smaller, routine transactions - like paying for international software subscriptions or professional services - spot rates are often more practical than forward contracts, which can involve additional setup and administrative effort.

Benefits of Using Spot Rates

One major advantage of spot rates is their transparency. You can see the exact rate available at any moment, with no need for complex calculations or adjustments for future delivery dates. This clarity enables finance teams to make quick and confident decisions.

Spot rate transactions are also highly liquid, meaning they’re accessible whenever needed during standard trading hours. Unlike forward contracts, which require advance planning, spot rates allow businesses to respond immediately to unexpected payment needs.

The simplicity of spot transactions is another plus. All you need to do is request a rate, approve the deal, and the exchange is completed within two business days - minimising administrative hassle.

Finally, spot rates offer a practical way to manage cash flow. If your business receives unexpected payments in a foreign currency, converting them at the spot rate ensures quick and efficient cash flow management.

Forward Contract Rates: How They Work and When to Use Them

Forward contract rates give UK businesses a way to manage currency risk by locking in exchange rates for future transactions. This approach provides financial certainty in an often unpredictable market.

How Forward Contract Rates Work

A forward contract secures an exchange rate for a currency transaction set to happen in the future. Unlike spot rates, which reflect the current market conditions, forward rates are calculated based on two main factors: the difference in interest rates between the two currencies and the current spot rate.

Here’s how it works: if UK interest rates are higher than those in the eurozone, the forward rate for GBP/EUR will generally be lower than the current spot rate. This adjustment accounts for the cost of holding one currency over the other during the contract period.

Forward contracts can be tailored to different timeframes, ranging from a few days to several years. However, three, six, and twelve-month contracts are the most commonly used by UK businesses. Once the forward rate is set, it remains fixed, no matter how the market moves later. This creates a binding agreement for both parties and allows for precise financial planning.

Benefits of Using Forward Contracts

Forward contracts bring a range of advantages, starting with budgeting certainty. By locking in exchange rates, businesses can make accurate forecasts and set realistic pricing.

They also offer protection against unfavourable currency movements. For instance, if you're a UK exporter expecting €100,000 in six months and the euro weakens significantly, a forward contract ensures you still receive the pound amount you planned for, shielding you from potential losses caused by market volatility.

Another key benefit is cash flow predictability. Businesses that make regular international payments, like manufacturers importing raw materials, can confidently plan their working capital, knowing their currency costs won’t suddenly spike.

Forward contracts can also provide a competitive edge in pricing. When bidding for international contracts, businesses can offer firm prices without adding large currency buffers. This often makes proposals more attractive while protecting profit margins.

Best Uses for Forward Contract Rates

Forward contracts are ideal for transactions with fixed, known future dates. They’re particularly useful for large, planned transactions. For example, property developers buying overseas real estate can lock in rates at the time of signing agreements, safeguarding against currency fluctuations during the often lengthy completion process.

They’re also a smart choice for businesses with regular international suppliers. A UK retailer importing seasonal goods from Asia can secure exchange rates months in advance, ensuring stable costs even if the market shifts during peak trading periods.

For project-based businesses with long timelines, forward contracts align well with project milestones. Construction companies working on overseas projects, for instance, can use forward contracts to match their currency exposure to specific phases of the project, reducing financial uncertainty.

Finally, businesses with predictable international cash flows - like software companies collecting annual licensing fees in US dollars or consultancies receiving quarterly payments in euros - can use forward contracts to stabilise their revenue streams and avoid the impact of currency fluctuations.

While forward contracts require commitment to specific dates and amounts, they’re a powerful tool for businesses with well-planned, unavoidable international payments or receipts. Unlike spot rates, which offer flexibility, forward contracts excel in situations where timing and amounts are fixed.

sbb-itb-1645b7c

Forward Contract Rates vs Spot Rates: Main Differences

Understanding the differences between forward contract rates and spot rates is crucial for UK businesses aiming to make well-informed currency decisions.

Side-by-Side Comparison: Forward Contract Rates vs Spot Rates

Here’s a breakdown of how spot rates and forward contract rates differ:

| Factor | Spot Rates | Forward Contract Rates |

|---|---|---|

| Settlement Timing | Immediate (within 2 business days) | Future date (typically 3, 6, or 12 months) |

| Rate Determination | Current market conditions | Current spot rate plus interest rate differential |

| Flexibility | High - can transact anytime | Low - fixed date and amount commitment |

| Market Risk | Full exposure to rate fluctuations | Protected from adverse movements |

| Planning Certainty | Limited - rates change constantly | High - locked-in rate enables precise budgeting |

| Best for | Immediate needs, opportunistic trading | Planned transactions, risk management |

| Cost Consideration | Market rate plus spread | Forward premium/discount built into rate |

The key distinction lies in timing: spot rates are ideal for immediate needs, while forward contracts cater to future transactions. This timing difference shapes all other aspects of these two options.

Rate calculation is another major point of difference. Spot rates are driven by real-time supply and demand in the currency market. In contrast, forward rates are calculated by adding the interest rate differential between the two currencies to the current spot rate. For example, if UK interest rates are 2% higher, a six-month EUR/GBP forward contract will likely include a premium.

This comparison lays the groundwork for understanding how these differences influence business strategies.

How Your Choice Affects Your Business

The decision between spot and forward rates impacts several aspects of your business operations and financial planning. As previously discussed, the mechanics of these two approaches differ, and these differences ultimately shape your currency management strategy.

Cash flow predictability is one of the most significant factors. Forward contracts allow businesses to lock in their currency costs months in advance, simplifying budgeting and financial planning. On the other hand, relying on spot rates introduces uncertainty but offers the flexibility to take advantage of favourable market movements.

Your organisation's risk tolerance also plays a pivotal role. Businesses with a conservative approach often lean towards forward contracts to avoid currency volatility, even if it means missing out on potential gains. In contrast, companies with a higher risk appetite may opt for spot rates, embracing the possibility of both gains and losses.

The size and frequency of international transactions further influence the choice. Large, infrequent transactions are often better suited to forward contracts, as even small rate movements can have a significant financial impact. For smaller, more regular transactions, spot rates may be a better fit, as the effects of rate fluctuations tend to balance out over time.

Market timing is another critical consideration. Forward contracts provide stability during periods of market volatility but may lock you into less favourable rates if the market moves in your favour. Spot rates, on the other hand, allow businesses to benefit from favourable movements but carry the risk of adverse shifts.

Finally, forward contracts require careful planning and commitment to specific dates and amounts, which may not be ideal for smaller businesses with limited treasury resources. In contrast, spot transactions offer simplicity but demand constant monitoring to optimise timing.

How to Choose the Right Rate Strategy

Understanding the differences between spot and forward rates is just the start. Choosing the right approach is essential for accurate financial planning, and the best strategy depends on your business needs and goals.

Key Factors to Consider

Transaction timing plays a major role in your decision. If you need currency within 48 hours, spot rates are the way to go. On the other hand, if you're planning payments for months ahead, forward contracts can help you budget more effectively.

Your risk tolerance also matters. If your business prefers predictable cash flows, forward contracts are a safer choice, even if it means missing out on favourable market swings. For companies comfortable with currency fluctuations, spot rates offer more flexibility.

Payment frequency and size can guide your decision too. Large, one-off international transactions - like purchasing a £500,000 property abroad - are more sensitive to small rate changes, which could mean tens of thousands in extra costs. Forward contracts can protect against such volatility. However, smaller, regular payments might be better suited to spot rates, as rate variations tend to even out over time.

Think about your planning capabilities and treasury resources. Forward contracts require precise planning and commitment to specific amounts and dates, which may be challenging for smaller businesses with limited resources. In such cases, spot rates might be easier to manage.

The nature of your international obligations is another factor. Businesses with consistent overseas expenses often benefit from the predictability of forward contracts. Meanwhile, companies making occasional or opportunistic purchases abroad might find spot rates more practical.

Finally, consider market conditions. In periods of volatility, forward contracts can provide stability, while businesses with flexible budgets may be better equipped to handle spot rate fluctuations.

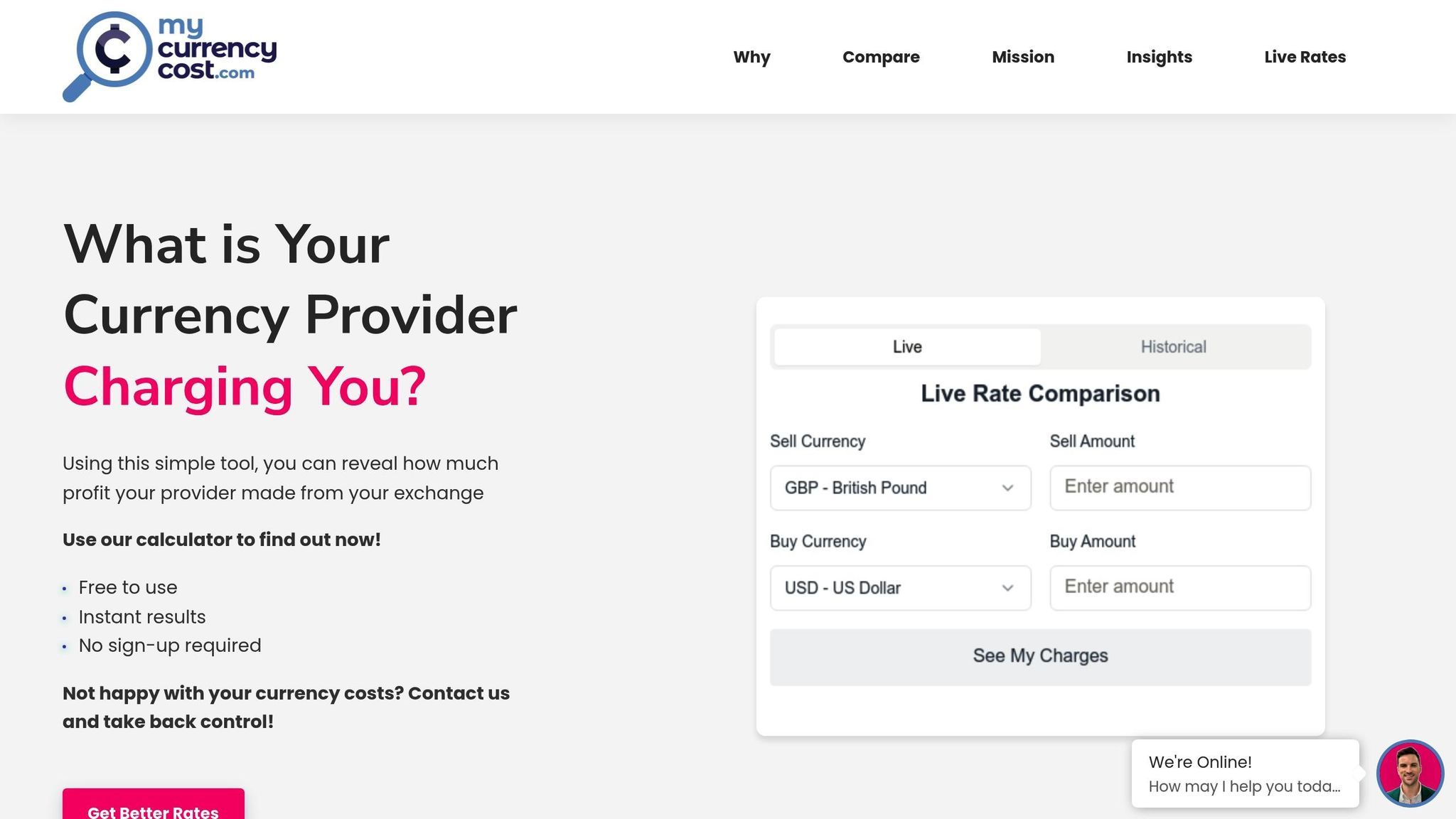

These factors provide a framework for selecting the right strategy and using tools like those offered by mycurrencycost.com to make informed decisions.

How mycurrencycost.com Can Help

With these considerations in mind, mycurrencycost.com offers tools designed to simplify and optimise your currency strategy.

The FX rate comparison tool gives you a clear view of exchange rates compared to real market rates. This transparency highlights any markups from banks or brokers, helping you make informed decisions about currency exchanges.

Historical rate analysis offers insights into past currency trends. By reviewing rate movements over time, you can identify patterns of volatility and determine whether current rates are favourable.

The forward contract rate checker helps you compare forward rates from different providers against fair market values. This ensures you're not overpaying for the certainty that forward contracts provide.

For more tailored advice, the platform’s personalised support connects you with currency experts. These professionals can guide you through complex decisions, especially when dealing with multiple currencies or large transactions.

Above all, mycurrencycost.com focuses on transparency, shedding light on hidden fees and markups. This clarity allows you to confidently compare spot and forward options, ensuring your chosen strategy aligns with your business goals and delivers real value.

Forward Contract Rates vs Spot Rates: Final Thoughts

Grasping the distinction between forward contract rates and spot rates is crucial for UK businesses aiming to navigate foreign exchange challenges effectively. With this understanding, businesses can shift from reacting to currency fluctuations to proactively managing them, safeguarding margins and maintaining steady cash flow even during periods of market volatility.

The decision to use spot or forward rates has a direct impact on your business's financial stability. Spot contracts are ideal for immediate transactions, such as urgent payments or seizing short-term rate advantages. However, they leave businesses vulnerable to future market fluctuations. On the other hand, forward contracts provide the security of fixed rates for future transactions, shielding you from unpredictable currency swings.

In many cases, a balanced approach works best. Combining spot contracts for flexibility with forward contracts for predictability allows businesses to adapt to varying market conditions. This strategy becomes particularly valuable when exchange rate volatility spikes, as forward contracts can offer a much-needed layer of financial protection.

To craft a currency strategy that works for your business, consider your risk tolerance, cash flow needs, and planning requirements. Whether you're purchasing property overseas for £500,000 or managing regular payments to international suppliers, the right approach can save significant amounts while providing the stability necessary for sound financial planning.

With tools like those offered by mycurrencycost.com, you can make these decisions with full transparency regarding rates and fees. This clarity ensures your strategy delivers tangible benefits, whether you're prioritising the flexibility of spot rates or the certainty of forward contracts.

FAQs

How do differences in interest rates affect forward contract rates compared to spot rates?

Interest rate differences significantly influence the link between forward contract rates and spot rates. When domestic interest rates exceed those of a foreign country, forward rates typically trade at a premium compared to spot rates. This reflects the higher expense of holding foreign currency. Conversely, if domestic interest rates are lower, forward rates often trade at a discount, suggesting potential depreciation or reduced carrying costs.

This relationship is explained by the principle of interest rate parity, which ties interest rate differences to movements in exchange rates. By grasping this connection, businesses can gain a clearer understanding of currency trends and make more informed decisions to manage foreign exchange risks.

What are the risks and advantages of using spot rates for frequent international transactions?

Using spot rates for frequent international transactions comes with both benefits and challenges. On the upside, spot rates are straightforward, fast, and immediate. They let businesses exchange currencies quickly without the hassle of lengthy agreements, making them ideal for time-sensitive payments.

That said, relying on spot rates also means exposing your business to currency fluctuations, which can make costs unpredictable. If the exchange rate shifts against you, it could affect your profits or disrupt your budget plans. While spot rates are undeniably convenient, it's important to evaluate your cash flow requirements and explore ways to manage the risks tied to market volatility.

When might a business benefit from using both spot rates and forward contracts in its currency strategy?

Combining spot rates with forward contracts offers businesses a practical way to balance flexibility and stability when dealing with foreign currencies. Spot rates work well for immediate payments or transactions, providing a quick solution for short-term needs. On the other hand, forward contracts allow businesses to lock in exchange rates for future payments, helping to minimise the risk of unpredictable currency fluctuations.

This dual approach is particularly beneficial for companies juggling immediate operational demands with long-term financial planning. By using spot rates for urgent payments and forward contracts to shield against future currency risks, businesses can maintain smoother cash flow, safeguard budgets, and respond more effectively to changing market conditions. This strategy is especially relevant for companies involved in frequent international transactions or managing global supply chains.