SMEs in the UK lose an average of £70,000 annually due to currency exchange rate fluctuations. For businesses with turnovers between £1 million and £50 million, managing foreign exchange (FX) costs is critical - especially when banks and brokers can add markups of up to 4%. Tools like mycurrencycost.com step in to help SMEs secure better rates and avoid hidden fees.

Key Points:

- Banks and brokers add up to 4% markup on FX rates, costing SMEs thousands annually.

- Currency volatility affects 51% of importing SMEs and 34% of exporters.

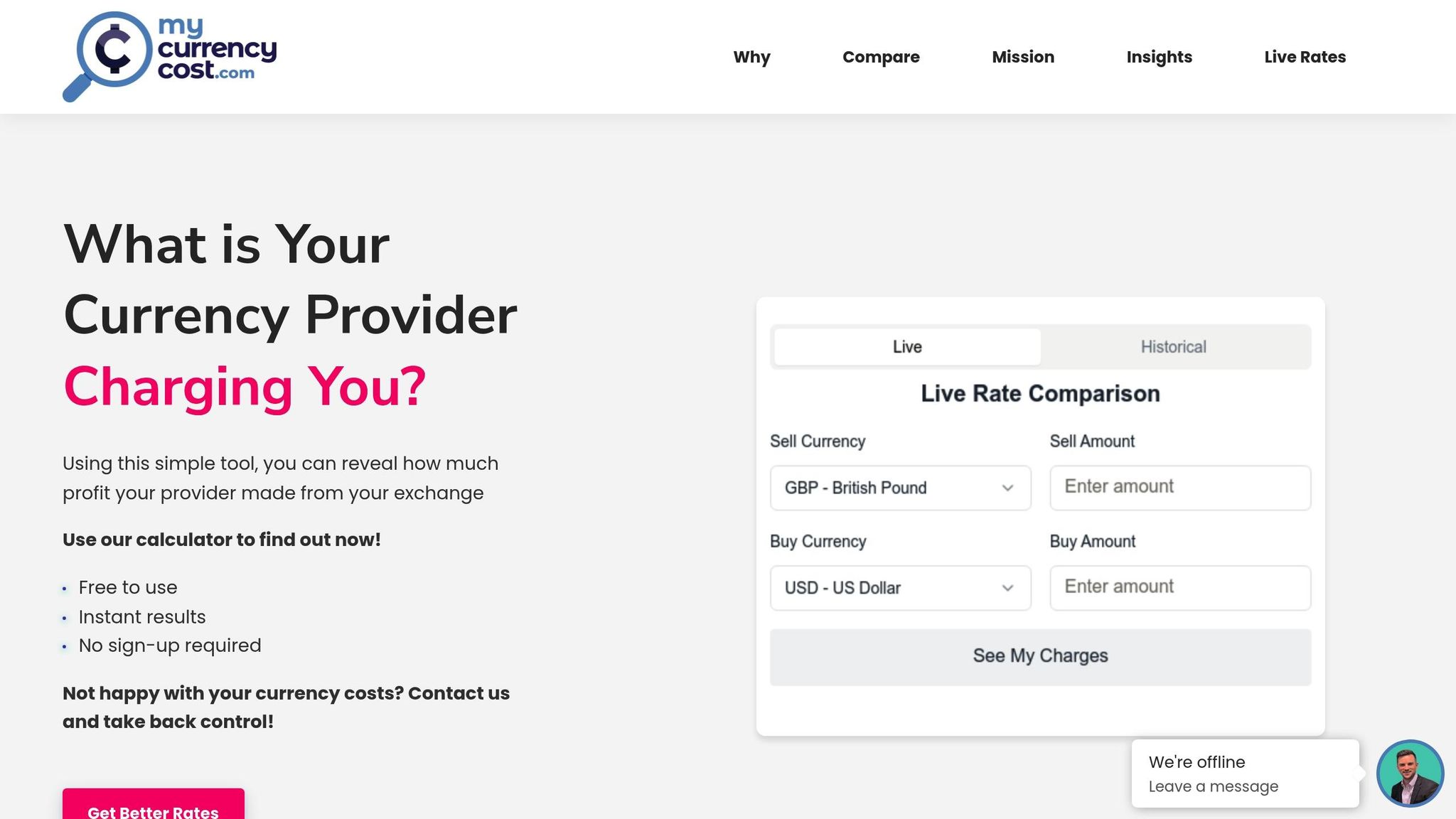

- mycurrencycost.com offers a free FX rate comparison tool to identify unfair markups.

- Features include instant rate comparisons and historical data analysis, but SMEs still need banks or brokers for transactions.

Quick Comparison Table:

| Feature | mycurrencycost.com |

|---|---|

| Purpose | Rate comparison and markup analysis |

| Execution of FX Trades | Not provided; requires separate FX providers |

| Key Tools | Instant rate calculator, historical rate analysis |

| Currency Support | Multiple currency pairs |

| Limitations | No transaction or hedging services; requires in-house expertise |

For SMEs, mycurrencycost.com is a straightforward tool to ensure fair FX rates, helping businesses cut unnecessary costs and protect their profit margins. While it doesn't handle transactions, its rate transparency empowers SMEs to negotiate better deals.

1. mycurrencycost.com

mycurrencycost.com is a platform designed to bring transparency to foreign exchange (FX) transactions for UK SMEs. Rather than offering FX services itself, it works as an independent auditing tool, comparing the rates businesses are quoted with historical wholesale market prices.

At the heart of the platform is its FX rate comparison calculator. By entering trade details, businesses can instantly analyse potential markups on their transactions. The rates are compared against reliable interbank market data, helping users confirm whether the quotes they receive represent fair value - a common concern with markups from banks and brokers.

For businesses handling regular international transactions, the historical rate analysis feature proves especially useful. This tool allows access to past wholesale market prices and forward contract rates, enabling companies to benchmark their deals, identify trends, and plan future transactions more effectively. Together, these features provide SMEs with the clarity they need to make better FX decisions.

The platform also acknowledges the fast-moving nature of currency markets, where exchange rates can shift significantly - even within a single minute. Despite this volatility, mycurrencycost.com offers highly accurate rate estimations to help businesses stay informed.

A real-world example highlights the tool's impact: one UK SME discovered that a broker had quoted rates 2.3% above and below the mid-market rate. Using the comparison tool, the business identified this markup and sought better alternatives.

"mycurrencycost.com exists to give you clarity over your currency charges. Ensure you're receiving fair value for the price you're paying by checking rates with our calculator."

sbb-itb-1645b7c

Pros and Cons

Understanding the strengths and limitations of mycurrencycost.com is key for SMEs looking to make informed decisions about managing currency risks. Here's a closer look at what the platform offers and where it falls short:

One of the standout benefits of mycurrencycost.com is its transparent approach. Acting as an independent auditing tool, it provides unbiased rate comparisons without any conflicts of interest. This is particularly helpful for SMEs with turnovers between £1 million and £50 million, especially those without dedicated treasury teams to analyse exchange rate markups.

The platform’s instant rate comparison feature is another strength. It allows businesses to see potential markups clearly, helping them evaluate whether rates are fair. Additionally, its historical rate analysis helps identify patterns in FX costs, making it easier to benchmark past transactions.

However, there are limitations to consider. Since mycurrencycost.com focuses exclusively on rate transparency, it doesn’t handle actual currency transactions. Businesses still need to rely on banks or brokers to execute their currency exchanges.

| Feature | Advantages | Limitations |

|---|---|---|

| Rate Transparency | Independent auditing with no conflicts of interest | Requires separate FX providers for transactions |

| Analysis Capabilities | Historical data and instant markup identification | Real-time accuracy may vary due to market volatility |

| Currency Support | Supports multiple currency pairs for comparisons | Limited to comparison only, not execution |

| Contract Options | Analyses forward contract rates | Does not offer contract provision or execution services |

Another challenge is that SMEs need to interpret the data effectively and implement sound hedging strategies. The platform doesn’t replace in-house FX expertise, which many SMEs lack, potentially limiting their ability to act on the insights provided.

Conclusion

For UK SMEs (£1m–£50m turnover), managing foreign exchange (FX) costs can be a daunting challenge. This is where mycurrencycost.com steps in, offering a straightforward way to compare FX rates and identify fair markups. The platform is particularly useful for businesses without dedicated treasury teams, helping them quickly assess if they're getting a reasonable deal on currency conversions.

What sets mycurrencycost.com apart is its ability to provide instant clarity on FX markups. Features like historical rate analysis and forward contract checks give businesses critical benchmarks to make informed decisions. Even small markups can add up to significant costs, and this tool empowers SMEs to negotiate better rates and take control of their FX transactions.

"In just a few clicks, you can tell if you're getting a fair deal or not for your currency conversions."

- mycurrencycost.com Home Page

It’s important to remember that mycurrencycost.com is a comparison tool, not a transaction platform. While it provides the data needed to negotiate better rates, businesses will still need to rely on banks or brokers to carry out their actual currency transfers.

For SMEs committed to reducing FX costs, mycurrencycost.com is a practical, cost-free solution to bring transparency to currency charges. By using the platform regularly, businesses can verify rates before transactions, track their FX expenses over time, and safeguard profit margins from unnecessary markups. Incorporating it into a routine FX strategy could be a game-changer for companies aiming to optimise their international payment processes.

FAQs

How can SMEs use mycurrencycost.com to secure better exchange rates with banks or brokers?

SMEs can turn to mycurrencycost.com to check live exchange rates and pinpoint the most competitive options on the market. With a clear grasp of current rates, businesses are better equipped to engage with banks or brokers, negotiating from a position of strength for more favourable deals.

The platform also offers insights into currency trends, giving SMEs the tools to showcase their expertise during negotiations. This can help them not only strengthen their bargaining position but also cut down on currency conversion costs, ensuring they secure the best rates for their transactions.

How does mycurrencycost.com help SMEs spot unfair FX rate markups?

MyCurrencyCost.com supports SMEs by comparing the exchange rates they’re offered with the real market rates, helping to spot hidden markups with ease. The platform also offers straightforward tools to calculate the actual cost of currency conversions, empowering businesses to make smarter financial choices and cut down on avoidable costs.

Why is it beneficial for SMEs to have FX expertise when using tools like mycurrencycost.com?

When your SME has a solid understanding of foreign exchange (FX), tools like mycurrencycost.com become even more effective. This expertise allows your business to pinpoint and handle currency exposure, adopt money-saving tactics, and reduce the risks tied to fluctuating exchange rates.

With this know-how, your team is better equipped to make smart choices about hedging strategies and timing currency exchanges. This ensures you secure favourable rates and avoid unnecessary expenses. For SMEs involved in international trade, this skill is crucial - helping you stay agile in unpredictable FX markets, maintain competitiveness, and safeguard your profit margins.